45l tax credit form

This property tax credit is only available on certain years - it has been suspended by. Arkansas Home Builder sold 35.

45l Archives Brayn Consulting Llc

We model every new home in the most cost effective energy efficient way.

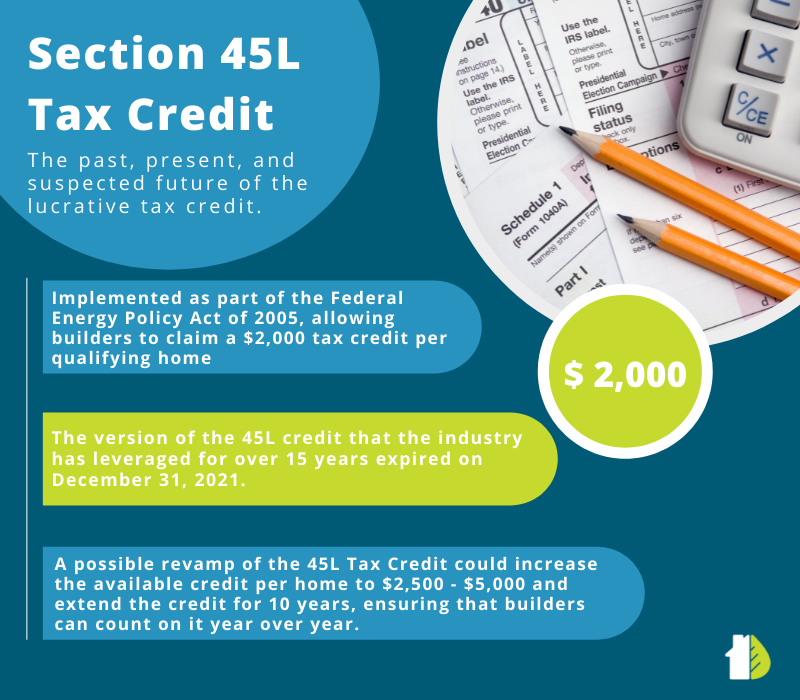

. The good news is that you can go back and claim the 45L credit for properties that have been built or remodeled in the past three years. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. There is no limit to the number of residential units for which you can claim the 45L tax credit as long as the homes meet the required energy efficiency standards.

You are eligible for a property tax deduction or a property tax credit only if. 45L Tax Credit Form - Tacoma Energy Products and Solutions New Home Construction. Instead they can report this credit directly on line 1p in Part III of Form 3800 General.

In late 2019 the tax credit was. Form NJ-1040-H is a property tax credit application available to certain home-owners and tenants. A key requirement of the tax credit is the sale close of escrow or lease executed leaserental agreement of the home or dwelling units during the taxable year the credit is claimed.

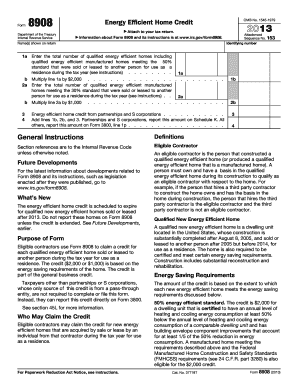

Are then added to determine the total credits for taxes paid to other jurisdictions. The Internal Revenue Code IRC Section 45L is a 2000 per dwelling unit 1000 for manufactured homes tax credit for each new energy-efficient home which is constructed by an. After the units are certified the eligible contractor can use Form 8908 to apply for or claim the credit which will pertain to the year the certified units were leased or sold.

The Arkansas homes were built in Zone 3 to 2012 IRC minimum code and 2014 Arkansas Energy Code for New Building Construction. There is no separate Schedule A for the MCTMT in this example since there is no excess of the New York. Eligible contractors use Form 8908 to claim a credit for each qualified energy efficient home sold or leased to another person during the tax year for use as a residence.

Complete or file this form if their only source for this credit is a partnership or an S corporation. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Irs 8908 Instructions 2021 2022 Fill And Sign Printable Template Online

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is The 45l Tax Credit Get 2k Per Dwelling Unit

45l Tax Credit What Is The 45l Tax Credit Who Qualifies

Section 45l Energy Tax Credit Past Present And Future Ekotrope

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

45l Tax Credit Energy Efficient Credit Richmond Cpa Firm

The 2 000 45l Tax Credit What You Need To Know Attainable Home

Is It Too Late To Take Advantage Of The Section 45l Tax Credit Cost Segregation Authority

45l A Key Strategy To Consider Before 9 15 Capstan Tax Strategies

8908 Fill Online Printable Fillable Blank Pdffiller

Is It Too Late To Take Advantage Of The Section 45l Tax Credit Cost Segregation Authority

Contracts Can Claim The 45l Tax Credit Tri Merit

Available Tax Credits Deductions To Generate Cash Flow

45l Tax Credit Overview And Analysis Of The Residential Efficiency Energy

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current

Kbkg Tax Insight Concurrent Irs Form 3115 Template Dcn 244 7

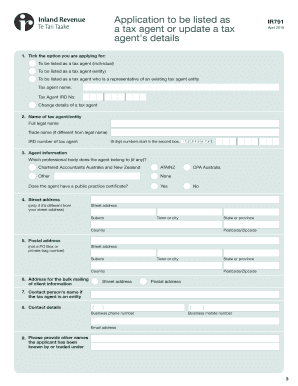

Fillable Online Tax Credit Claim Form 2018 Ird Fax Email Print Pdffiller