ny paid family leave tax rate

The maximum employee contribution in 2018 shall. Insurance Industry Questions.

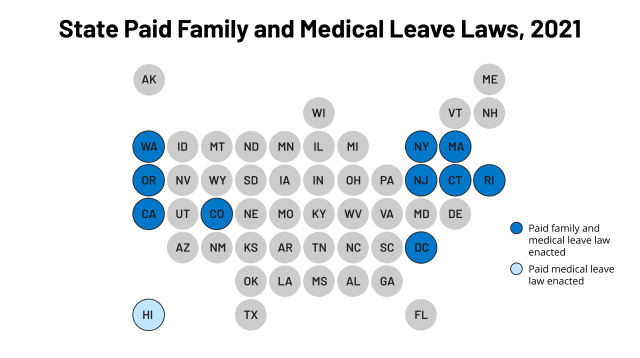

Paid Family And Medical Leave An Issue Whose Time Has Come

The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New.

. Contribution rate for Paid Family Leave in 2020 is 0270 of the employees weekly wage capped at New Yorks current average annual wage of per employee per year. No deductions for PFL are taken from a businesses tax contributions. Decision on Premium Rate for Paid Family Leave Benefits and Maximum Employee Contribution for Coverage Beginning January 1 2023.

If your employer participates in New York States Paid Family Leave program you need to know the following. New York paid family leave is funded completely through employee contributions. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current New York State Average Weekly Wage NYSAWW.

Any benefits you receive under this program are taxable and included in your. EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions. But come tax time you will likely face a hefty charge.

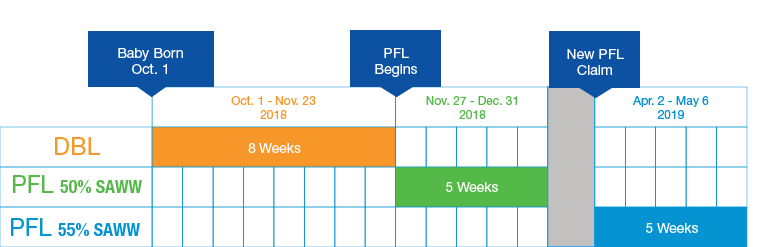

Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. In 2022 these deductions are. The contribution rate beginning January 1 2022 has been set at the same level as calendar.

Use Paid Family Leave. What Is Ny Paid Family Leave Tax. All Plans must be accepted by the Board and will need to adhere to the statutory requirements of the New York State Disability and Paid Family Leave Law WCL Section 211.

The NYS Department of Paid Family Leave PFL has announced its 2022 contribution rates. If you have a question or need assistance call 800. If you are unable to find the answer to your insurance question here check our FAQs.

For 2022 the SAWW is. 2021 Paid Family Leave Rate Increase TOP 2021 Paid Family Leave Rate Increase SHARE On December 23 2020 the Office of the State Comptroller issued State Agencies. 2022 Paid Family Leave Rate Increase SHARE On December 29 2021 the Office of the State Comptroller issued State Agencies Bulletin No 1982 to inform agencies of the 2022.

Find your employers paid family leave insurance carrier You may search by your employers name using the search function on the Workers Compensation Board website to find your employers. The maximum employee contribution rate will remain at 0511 effective Jan. Once a Plan has.

Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. In 2021 employees taking Paid Family Leave will receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage of 145017.

The New York State Department of Financial Services has announced that the 2021 premium rate and the maximum weekly employee contribution for coverage will be. For 2023 the NYSAWW. Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will.

This Decision sets forth the. Keep in mind that different states tax winnings at different rates. That would leave you with 659753910.

Ny Disability Benefits Law Paid Family Leave Shelterpoint

2022 Federal State Payroll Tax Rates For Employers

2022 Paid Family Leave Requirements State By State Onpay

View All Hr Employment Solutions Blogs Workforce Wise Blog

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Payroll Tax Calculator For Employers Gusto

Ny Paid Family Leave 5 Key Changes For 2019 The Standard

Washington S Paid Family Leave Program Running Short On Cash The Seattle Times

Getting Paid Hourly Associates

How To Build A Paid Family Leave Plan That Doesn T Backfire The New York Times

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

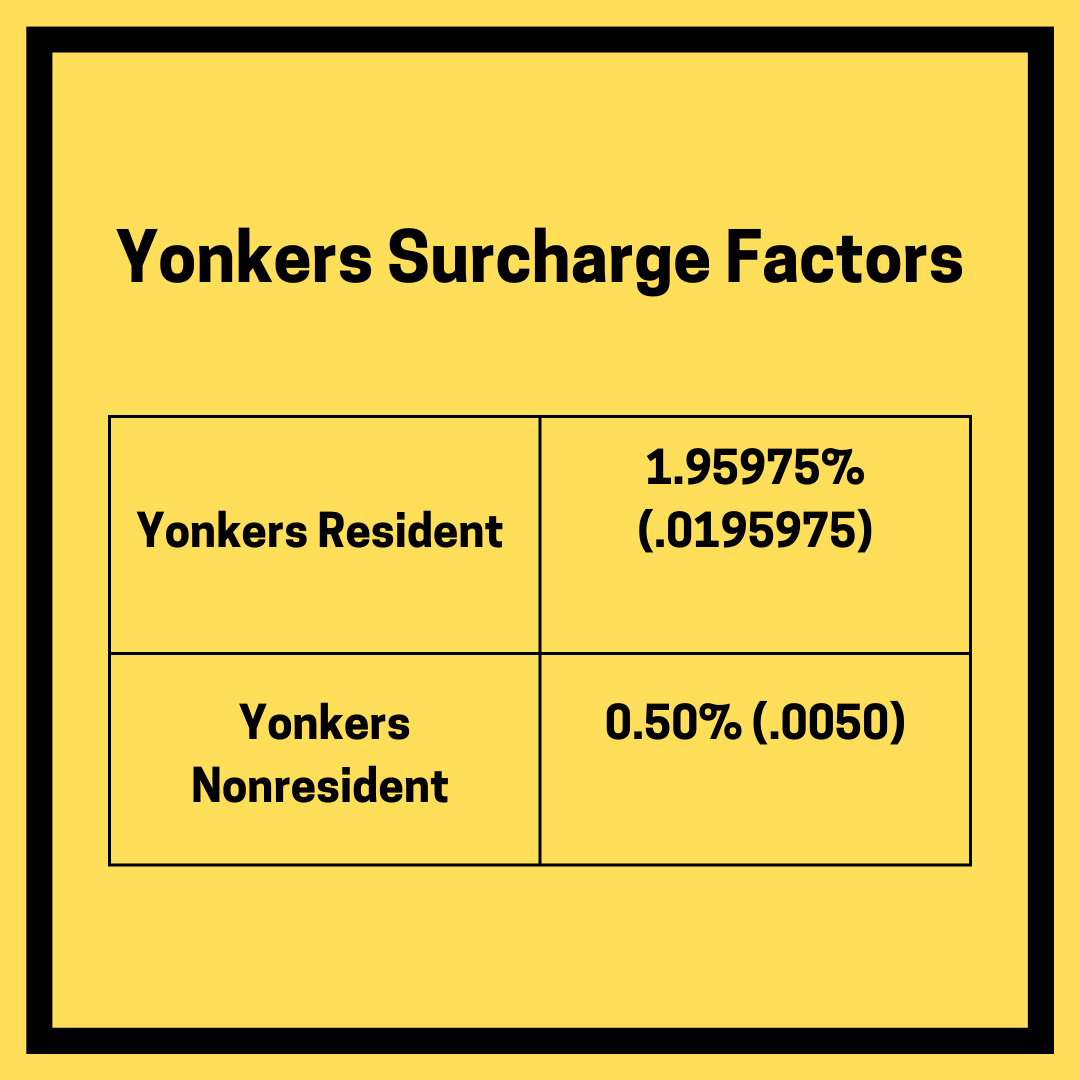

A Complete Guide To New York Payroll Taxes

Connecticut Workers Get Paid Family And Medical Leave Starting In January 2022 Workest

What Is The Bonus Tax Rate For 2022 Hourly Inc

2022 Ny Paid Family Leave Rates Payroll Deduction Calculator Released

New York Paid Family Leave Updates For 2021 Paid Family Leave